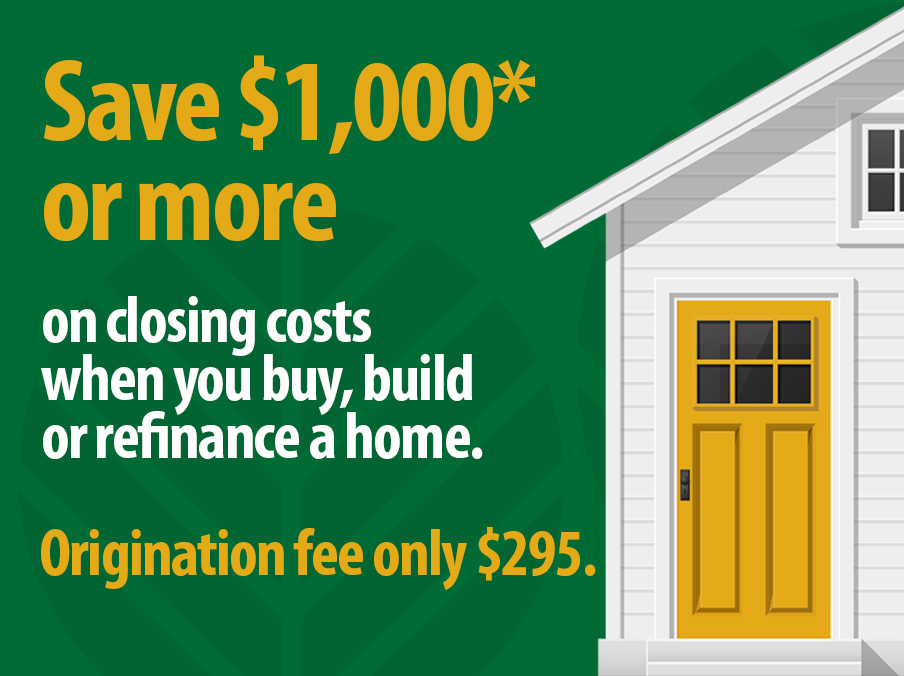

Protect Your Safe Place

For many of us, home is where the heart is, so why not protect it? With options to protect your real estate, home or even the apartment you rent, we’ll make sure your safe place is covered.

Get a QuoteHome Insurance For Your Peace of Mind

Home, it’s your safe place. It’s where families are raised and memories are created.

Protect this safe haven with homeowners insurance or real estate insurance that fits your needs. Once you have the coverage you need, enjoy the moments that matter.

Renting a Home or Apartment?

We have renters insurance to protect yourself from loss of or damage to your possessions.

Just because you don’t own a house, doesn’t mean you can’t protect your personal property.

Insurance to Protect Your Commercial Property

Looking to make sure your commercial property is protected just as much as your home?

We have options to help you protect commercial buildings you manage.

Home Protection Plan

1 YEAR – $159

- Home Deductible Reimbursement

Up to $2,500 per loss, 1 claim per 12 months - Home Glass Breakage

Up to $200 to replace the broken window, 2 claims per 12 months - Home Lockout

Up to $100 per lockout, 2 claims per 12 months - Appliance/Electronic Repair

Up to $500 per occurrence, max $1,000 per 12 months

Receive a 50% reimbursement of the payment made to a repair facility to repair an appliance or piece of electronic equipment - Emergency Lodging

Up to $1,000 in the event that the member’s primary residence becomes uninhabitable

Need help finding the right coverage?

Chat with our insurance team

Why The Insurance Office at MMFCU?

At MMFCU, we believe that true financial growth can only happen when we all grow together.

Insuring the things we buy and care about in a way that makes the most of our money just makes sense. That’s why The Insurance Office is independent and can look at multiple insurance carriers to find the best coverage and cost for each of our members. Mid Minnesota is rooted in locals serving locals, for the good of our community. We care about this community because it’s our home too. When you progress, so do we and in turn, we help others do the same. Owned by members (that’s you!) and led by members–that’s the credit union difference.

Home Protection Plan

1. Home Deductible Reimbursement: We will reimburse the covered Member for a Loss that occurs during the Coverage Period to the Member’s Primary Residence or Personal Effects, equal to the deductible limit shown on the Member’s Home Insurance policy or up to a maximum of $2,500 per claim, whichever is less. Coverage is effective from the date of the Member’s enrollment. Only one (1) Home Deductible Reimbursement benefit will be paid per claim occurrence, and only one (1) claim per Member will be paid per twelve (12) month period.

2. Home Glass Breakage: If during the Coverage Period, a window is broken at a Member’s Principal Residence, Home Glass Breakage will reimburse the Member up to $200 to replace the broken window. Coverage is limited to two (2) claims per twelve (12) month period.

3. Home Lockout: If during the Coverage Period, the Member is locked out from their Principal Residence, Home Lockout Reimbursement will reimburse up to $100 for a licensed locksmith to allow the Member to enter their Principal Residence. Coverage is limited to two (2) lockouts per twelve (12) month period.

4. Appliance/Electronic Repair Reimbursement

After thirty (30) days from the effective date of membership, the Member is eligible to receive a fifty percent (50%) reimbursement of the payment made to a repair facility to repair an Appliance or piece of Electronic Equipment that is located in the Member’s Primary Residence during the Coverage Period. The repair and repair payment must occur thirty (30) days after the effective date of the membership.

Appliance means an electrical device owned by you that is plugged into the house’s electrical system and is located within the interior of your Primary Residence including the attached garage. Appliances include: cooktops, dishwashers, dryers, freezers, microwave ovens, ranges, refrigerators, trash compactors, vacuums, warming drawers, washers, and wine coolers.

Electronic Equipment means electronic devices owned by you and located within the interior of your Primary Residence including the attached garage. Electronic equipment includes: desktop and laptop computers, tablets, digital video recorders, DVD players, garage door openers, home audio components, laptop computers, power tools, televisions, and television receivers.

The maximum repair reimbursement amount the Member can receive per claim occurrence is $500.

The maximum repair reimbursement amount the Member can receive per twelve (12) month period is $1,000.

5. Emergency Lodging Reimbursement We will reimburse the covered Member, up to a maximum of $1,000 per claim occurrence, in the event that the Member’s Primary Residence becomes uninhabitable during the Coverage Period due to events beyond the Member’s control. These events are limited to break-in, Theft, tornado, hurricane, earthquake, flood, fire, landslide and mandatory evacuation.

10 nights at $100 each up to $1,000

We will also reimburse the covered Member, up to a maximum of $1,200 per claim occurrence, for lodging expenses in the event of:

1. A sudden breakdown of their only air conditioning unit in the Primary Residence in the summer (defined as occurring within the following months/days of the year: 6/20 – 9/23), or a sudden breakdown of their only furnace in the winter (defined as occurring within the following months/days within the year: 12/21 – 3/20), that results in the unit remaining completely non-operational for 24 hours or more (from the time of the first service visit from the Service Provider) due to a delay in availability of the required repair parts to the Service Provider for their completion of the repair; or

2. A sudden break in their water pipes in the Primary Residence that results in the residence being flooded if the removal of the water by the Service Provider is delayed by 24 hours or more from the time the documented service request was made by the Member.

12 nights at $100 each up to $1,200

This summary is a brief overview of the program and is not to be considered a full disclosure of policy terms. Please refer to the Terms and Conditions for complete forms, conditions, limitations, definitions, and exclusions. This Plan is subject to a 30 day rate review.